Going into 2009, online rail retailing felt quite vibrant again.

More TOC’s embrace online

During the course of 2006-2007 nine new franchises and one new open access operator had commenced, all with ambitious business plans.

Several included strong online retail aspirations – none less so than CrossCountry. This franchise was unique in that it operated no stations nor ticket offices. For any sale made at a station, it paid out 9% commission to another operator. For any sale online, that dropped to 5%. Furthermore, as a long-distance operator, with many leisure routes, the ability to yield manage fares and stimulate demand through marketing were very important. It was one of the first train companies not to simply buy a rebranded colour-wash of an existing site, but to come armed with a list of new features it wanted to offer to its customers – including an interactive seat picker, reservations until 10 minutes before departure, and a new way of presenting fares choices.

This appetite from CrossCountry and other TOCs for new features and turbo charging the growth in online sales was on one hand much welcomed, but was also practically rather difficult for thetrainline to accommodate whilst also trying to catch-up on a backlog of technical work, after years of replatforming.

New trainline

2009 would finally see trainline migrate its own site, and those of its TOC clients to its new technology platform. This got rid of the “please wait” pages and brought the front-end up to date with the so called “Web2.0” look and feel. For the first-time basics such as predictive text for inputting station names, and calendar pickers for date fields, made the site easier for customers to use.

The replatforming project had also significantly changed how it developed and maintained its systems, now consisting of a much larger in-house capability, and third-party teams under its own management. This made the significant move away from 1990s waterfall IT management practices to derivatives of Agile software development, supported by tools for automated testing and automated deployment. As part of this it also needed to evolve how the industry managed its testing and accreditation regime, which has been designed for an era of a small number of major changes per annum. They obviously successfully sold the benefits of automated testing, as the head of accreditation for the industry later left and established a business providing automated testing services!

Under a new CEO, trainline was also on the charm offensive to repair and reset its strained relationship with train companies and the industry more widely.

Figure 11: New trainline homepage

Rapid prototyping

Whilst trainline’s core development team were busy with replatforming, a small “rapid prototyping group” had been spun up to innovate independently. This brought several key features to market: – “Best Fare Finder” – finally bringing a calendar view to see the best fares across a week or even a whole month at a glance, and “Ticket Alert” – allowing customers to be automatically notified as soon as tickets went on sale for key periods such as Christmas travel. These products were characteristic of the push at the time to address key customer pain points in choosing to travel by train.

Print@Home ticketing

2009 would also make key inroads into barcode ticketing, enabling customers to print their own tickets on normal A4 paper. There had previously been a number of proprietary pilots of self-print and mobile ticketing, but this was the launch of a national standard, evolved from the European UIC standard, that allowed “normal” mainstream fares to be issued. Initially launched with Virgin Trains in 2009, and more widely in 2010, it was initially limited to train specific “Advance” tickets and primarily on routes without automatic ticket gates. At the time there was no barcode scanning capability in train companies, so trainline also had to commission work to build a barcode scanner device to support the pilots. Nonetheless the approach primarily relied upon a “tamper proof” image, and the customer carrying proof of ID as a fallback.

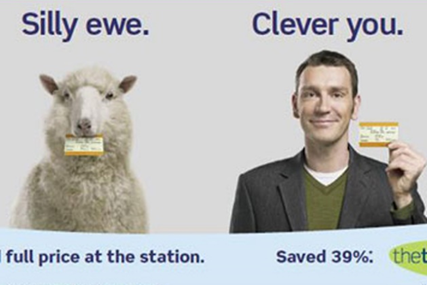

Marketing

Another big change at this time was digital marketing. This market was rapidly evolving, and combined the best of marketing creativity and technical innovation. Once the realm of “creative types” and “big brand”, marketing equally became the home of “big data” and spreadsheet power-users. There was significant competition for customers between National Rail Enquiries, train companies, and trainline driving up the cost of online marketing, but in the same vein making rail extremely visible and prominent online. This was an era when the quality of online marketing, and the size of online marketing budgets were key drivers of business volumes.

There was nonetheless still a significant role for offline marketing too.

The inflection of digital marketing jargon, rail industry jargon and tech jargon created an arena with a unique language all of its own.

Figure 12: trainline's 2009 "Sheep" themed advertising, included advertising jackets on a flock of sheep near Dorking

Industry systems woes

At the time of privatisation, the industry sold off “British Rail Business Systems”, and the guiding mind for industry architecture (and the procurement of suppliers to deliver it) transferred to RSP (later to become part of RDG). The inherited systems were slowly replaced by new ones.

One of the major changes to impact upon online retailing was the “new reservations system” launched on Boxing Day 2004. This system dealt with all the availability requests to see which fares were available, along with dealing with reservations, and printing seat-labels for trains.

This was one of the first systems to show the strain of the growth in online sales, and for a period would regularly fail in the weekly peaks around the middle of the day on Mondays and Tuesdays. At the time trainline provided online ordering and ticket printers to both the Royal Household, and the Cabinet Office. This would allow me the unique opportunity to phone RSP colleagues with the question “I’ve just had Downing Street on the phone wanting to know when it will be fixed?”.

It became apparent at this time that the industry had no real systems operations functions to provide operational oversight of its web of systems. RSP was a “9 to 5” organisation, and in theory the sub-contracted suppliers would provide 24x7 helpdesks and out-of-hours support. In practice this meant that online retailers were the first to notice issues with industry systems, and had to take the lead in incident management. A technical failure would be covered by one of the sub-contracted suppliers, but many failure scenarios were not technical failures. A common scenario would be data errors. Data was usually the TOCs or RSPs responsibility, not covered by the 24x7 support contracts, including anything from fares to reference data. Erroneous data files had the ability to bring systems to a halt (particularly if they were rushed by someone just before leaving the office on a Friday afternoon). Often resolution out-of-hours relied on goodwill, personal contacts, and personal phone books!

More new entrants

2010 saw three new entrants into the realm of online rail retail: MyTrainTicket.co.uk, Red Spotted Hanky and Quno.

MyTrainTicket was launched by a company called Assertis. Assertis itself was founded in 2000 as a generalist web agency, but in 2006 won a contract to provide a simple website for Wrexham and Shropshire Railways, who were bidding to operate as an open access operator between Wrexham and London. When their services launched in 2008, Assertis was chosen to supply the online ticketing services, and provided a pioneering new mobile and self-print ticketing service. This was expanded to pilot mobile tickets on Chiltern shortly after. Having seen the scope to innovate and disrupt the market, this catalysed the launch of MyTrainTicket in 2010, leveraging Assertis’s digital marketing skills, whilst offering customers the benefit of earning Airmiles. Assertis would go on to run Northern Rail’s online retail from 2011 – 2016, establish the “On Track Retail” joint-venture providing online retail for GoVia franchises in late 2014, and run the Caledonian Sleeper site from 2015. MyTrainTicket as a “direct to consumer” site was sold in 2012, with Assertis focusing on TOC and third-party branded channels. Assertis has been a driving force for innovation, in particular playing a pivotal role in the trial and adoption of mobile ticketing in 2016, and in establishing the “Independent Rail Retailers” to provide a collective voice for the sector.

Figure 13: mytrainticket.co.uk images

Red Spotted Hanky was launched by Atos Origin, leveraging the platform that they had built for GNER, and led by two of the team that had previously led CrossCountry Trains’ online strategy. For many years Atos Origin and Red Spotted Hanky would be trainline’s most significant competitor. At its peak, providing websites to ten TOCs: East Coast, Southern, Southeastern, Chiltern, London Midland, First Great Western, TransPennine, Hull Trains, c2c, and Scotrail. Whilst Red Spotted Hanky’s digital marketing, and absence of booking fees, made it particularly successful with the sizeable student market. Red Spotted Hanky is still around to this day, albeit without any significant marketing volumes are low. The Atos Origin platform, now run by Worldline following the various mergers and restructuring, continues to underpin the First Group TOCs online retail offering.

Figure 14: Red Spotted Hanky advert (~ 2013)

Quno was more of an anomaly, launched by global rail technology company SilverRail. SilverRail’s main strategy was to provide systems and APIs to underpin the propositions of others, at the time particularly in b2b markets. Industry licensing required licensed retailers to have an online presence, and hence Quno was launched. There was no significant marketing, and it remained largely unknown.

2010 finished with the greatest choice ever of places where customers could by train tickets online. The competition for customers was fuelling digital marketing, and also the drive to create new features and make sites easier to use. It was once again a fun time to be working in the sector.