It’s difficult to come up with a snappy title for this era. For Trainline people it is perhaps best known as the KKR era (their owners for the time) – but that would be overly Trainline centric, for an era when there was a lot else happening. A lot of it would fit under the theme of “international” – but a few bits wouldn’t fit there either. Let’s just call it “Maturing, with an international flavour”

Trainline

2015 saw the sale of Trainline from Exponent Private Equity, (who had owned the business for nearly a decade since acquiring it from Virgin and National Express in 2006), to global giant KKR. The aim for this next chapter was widely believed to be to prove that Trainline’s business model could scale outside the UK, and ready the business for an IPO.

Trainline’s initial approach to overseas expansion was to build the capability out of its existing teams. The existing technology was very UK specific, and international would require a more generic platform capable of presenting and selling rail content from many different markets. Similarly international expansion would require many new relationships with rail operators across Europe to gain the commercial agreement to sell their inventory (many of whom did not welcome the opportunity).

To accelerate the process, 2016 Trainline acquired the French online rail retailer, Captain Train, and this would turbo-charge the move to diversify outside the UK. Shortly after the acquisition Captain Train was rebranded as Trainline.eu, and over the following three years the businesses and technology platforms would be merged.

Go Euro / Omio

Whilst Trainline was branching out from the UK into the EU, the German online travel comparison site, Go Euro, was expanding into the UK. Go Euro rebranded as Omio in 2019. You may be excused from not being familiar with either brand. However, Omio provides European rail content to Uber, a brand where a recent push into rail has been hard to miss.

Trip.com / TrainPal

2018 saw Chinese-based, NASDAQ-listed, Online Travel Agency, Ctrip (the world’s second largest travel company), launch a rail app for the UK market – TrainPal.

The app has been quick to develop and launch features including split-ticketing and a secondary ticket market.

Virgin launches a new platform

In 2017 the East Coast franchise, this time in the guise of Virgin Trains East Coast (VTEC), brought a new online retail platform to market for the second time.

Up until this point, Virgin Trains (on the west coast mainline) used Trainline, and VTEC (on the east coast mainline) used Atos Origin. A rather confusing proposition for customers to have two franchises called Virgin, with different online retail experiences, and the need to register twice. The change did nothing to harmonise the two, but simply to replace the platform that VTEC were using for the East Coast mainline.

The 2017 site had its origins five years earlier, when Stagecoach (who were the 91% shareholder in Virgin Trains East Coast) decided to invest in a global ticketing strategy, delivered through an integrated ticketing platform.

Part of this was Stagecoach’s rail “Core Booking Engine” known as CBE. This was designed as a multi-channel platform that would handle all rail bookings, and associated customer records, across all channels. The theory being that this would make it easier to provide a consistent experience for customers, a single view for the business across its channels, and ultimately be more efficient.

It had the advantage of coming to market at a time when the market was relatively mature, and being able to both learn from those that had gone before in the GB rail market, and bring Vix Technology’s global ticketing experience. From my brief time working with the platform, the underlying booking engine was one of the most logical and ‘cleanly’ structured. Albeit, like many that had gone before, some significant lessons were learnt about quite how much scope was involved, along the way.

By the time it launched in Virgin Trains East Coast (VTEC), however, Virgin were already looking for the exit. This frustrated investment, and the site that had launched with much promise, appeared to stall and lag behind others in the market. By the end of 2019 Stagecoach had exited all their GB rail interests. The contract for the East Coast ‘core booking engine’ was novated to LNER, who have continued to build upon this as the foundations of their online retail experience.

Arriva ACE

Stagecoach was not unique in building a digital platform for all its GB rail interests. Arriva were also following along.

The Arriva platform, known as ACE – Arriva Customer Engine, was designed to bring together digital propositions across Arriva bus and rail businesses.

The rail proposition launched in 2018 with Chiltern and Grand Central. Curiously, Arriva’s CrossCountry franchise has, however, remained with Trainline.

Hindsight

2018 saw the arrival of an app that had potential to significantly disrupt the market: Hindsight.

In many ways Hindsight was a conventional rail retail app that allowed you to plan rail journeys and buy tickets, but its “killer feature” was that it would look back at your bookings retrospectively, and if a cheaper ticket had been valid for the journeys you made, automatically refund your original booking and replace it with the cheaper one. For example, if you booked an Anytime ticket but travelled in the off-peak, it would swap you to an Off-Peak ticket. If you bought multiple single tickets, but a day return was cheaper, it would swap that for you.

It was never entirely clear if this approach fitted within the industry rule book!

Hindsight went into administration in early 2019, but the technology was acquired by Stagecoach who looked at new avenues to bring it back to market.

Seatfrog

Another innovative arrival in 2018 was Seatfrog.

Seatfrog had started in Australia as a service to auction excess business class inventory for airlines. That was, however, a market that was getting saturated depressing margins, alongside a desire by airlines to build the capabilities in-house.

Seatfrog was attracted to a Virgin Trains East Coast innovation competition, and quickly realised the potential to pivot their proposition from airlines to European rail. The business, founders and employees relocated to London and quickly launched first class upgrades for Virgin Trains East Coast. Within two years they had signed up almost all relevant TOCs, and diversified their proposition to also include “train swap” (allowing customers to pay to use an inflexible ticket on a different train) and “super fare” (a proposition where customers can save money by choosing the day/time window of travel, but are allocated to specific services rather than choosing them). Seatfrog also sells “normal” tickets for all operators to complete the proposition.

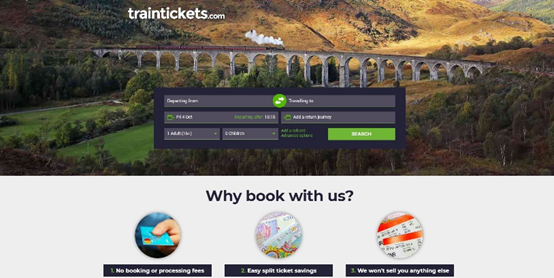

traintickets.com

2019 saw the launch of traintickets.com – cofounded by one of the team that had previously helped moneysavingexpert launch their split ticketing proposition (this no doubt helped with a little bit of launch publicity from Martin Lewis!). Indeed, a key launch feature of traintickets.com would be the ability to find split ticketing options. The business was later taken over by Atomised Co-operative Ltd.

Pico4UK

An international flavour of a different kind was brought to online retail in 2019, when c2c rolled out a UK version of Trenitalia’s domestic “electronic ticket issuance system”. Trenitalia’s other GB rail interest, Avanti, would also move to this platform at the end of 2020. Similar to Stagecoach’s CBE, this was also built as a multi-channel platform.

Perhaps I read too much into a name, but a “ticket issuance system” sounds very transactional. Something that does what it says on the tin, and issues tickets. Contrast that with “retail” – retail to me is a broader process that transitions from marketing into product discovery, conversion, sale, payment, ticket issue and supporting the customer with their onward journey. Retailers understand their markets, the behavioural science and psychology that leads people to make choices. Retailers use nudges and subtle influence to generate sales.

I do not mean to pick-on Trenitalia, nor Pico, specifically, but it is an illustration that a number of these new platforms felt a bit like IT projects. Simply getting them functional was a huge challenge, and it felt like budgets ran out before they could be polished into slick retail propositions. They delivered functional systems that were about as exciting as accounting and payroll systems. The TOCs may have got themselves capable IT platforms to do the payment and ticketing, but often with rather limited associated digital systems to really drive conversion, nor on-going innovation. The digital teams were generally small, and inevitably it would be harder to recruit global digital talent into businesses that were not global digital businesses. They would be fighting for ongoing investment against all the other funding priorities a transport group has.

Trainline IPO

For Trainline, 2019 was a significant year. In June 2019, just over 20 years after first launching online, Trainline floated on the London Stock Market with a value of £1.68bn. (A market capitalisation greater than many of the transport operating groups that actually run the trains).

A few months later at the end of the year, Virgin Trains, who had started it all 22 years earlier, left the rail industry as its final franchise came to an end.