At the start of 2004 there were a lot of reasons to be positive about the outlook for both thetrainline and Qjump. However, unbeknown to most at the time, by the end of the year there would only be thetrainline left in the game.

On Monday 9th February, just after 9am, the 200 staff at Qjump were told that thetrainline had acquired the business, and was starting a consultation on making all staff redundant. Many had worked their entire careers in the railway, and just weeks earlier they thought that they were a key part of a leading edge of its future.

Different people put different emphasis on the factors that led to that outcome. The official line, from thetrainline’s commercial director at the time, was that thetrainline had saved Qjump from going bust. In practice thetrainline had spent much of 2001 courting other industry players to invest in its loss-making business. Investors were beginning to realise that online retailing was not just a one-off investment that would give long-term rewards, but were businesses that would need constant investment in technology and marketing. Stagecoach was keen to exit its investment in thetrainline, and Qjump’s losses were a blot on National Express’s otherwise recovering rail portfolio. The merger solved issues for various parties.

The restructuring saw National Express take 14%, Virgin Rail Group 13%, and Virgin Group 73% of the new combined entity, which was led by thetrainline management team. Investment in the Qjump platform and marketing stopped immediately, and during the course of 2004 the call-centre was closed down and work transferred to thetrainline’s new outsourcing partner Sitel. A small mitigation was that at the time National Rail Enquiries was opening a new call-centre in the Dearne Valley, and were able to offer new roles to some of the team facing redundancy.

It was always an assumption that the merger would lead to one or other technology platform being shutdown. Whilst it was a reasonable assumption that as the bigger player thetrainline’s systems would be adopted, you might reasonably expect a detailed comparison of the two systems, comparing features and non-functional considerations such as throughput. Qjump’s systems were only three years younger that thetrainline’s, but at that time this was a whole generation. The Java platform was generally regarded as more scalable and secure than the Microsoft platform used by thetrainline. In practice, however, these factors barely came into play. The two big factors being (a) how much prior investment would need to be written off; (b) how simple would it be to terminate either supplier’s contract. thetrainline’s systems were chosen. The various websites were migrated to thetrainline.com’s platform, and Qjump’s technology shutdown.

In Qjump’s 25 months online, it had grown to an annualised run rate of 1m ticket sales, from 15m visits.

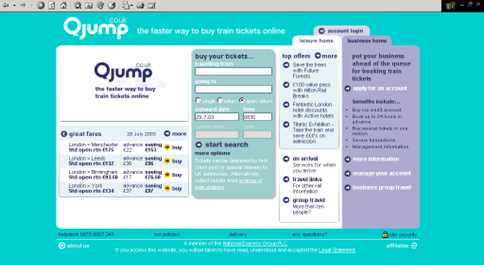

Figure 8: Qjump homepage just before the acquisition by thetrainline.com

Cost focus

With an average ticket value of £35 at the time, and therefore £35m of sales, it is tempting to assume that it should be easy to be profitable. The reality is that the finances of online retail have always been much more marginal. Retailers earn a commission on sales. This was 9% prior to 2008, and has come down since: first to 5.5%, now 5%, and will reduce further to 4.5% next year.

From this 9% the retailer needs to cover all its overheads, marketing, investment and of course the direct cost of sale. At the time the direct cost of sale alone consisted of:

- Ticket fulfilment, either post or paying issuing fees to stations (~ 80p - £1 / 2.5%)

- Lost in post replacements, at times about 1% of postal volume (about ~ 0.5% of revenue)

- Credit/debit card fees (then about 1.2% of transaction value)

- Credit/debit card charge backs, (at times exceeding 1%, but usually much lower)

- Staff costs for customer helpdesk & fulfilment (~ 1.5%)

- Industry costs for querying industry reservation service and data feeds (~0.8%)

In addition to the above there were the costs of running and enhancing the technology, marketing, and general overheads.

The business case for online retail as part of a train company could pull additional levers – not least that each sale that migrated online from telesales was a cost saving. A proportion of sales were assumed to be generative (a survey for Virgin/thetrainline.com in 2001 found that a third of customers booking online would not have travelled by train, had the option to book online not been available). The costs for issuing tickets at stations were ‘wooden dollars’ (paid by Qjump or thetrainline, but received by a TOC still within common ownership).

The move to a fully arm’s length business could no longer rely on these ‘other benefits’ and had to be profitable in its own right. The reality was that the business case needed systematic optimism bias, and a plan of initiatives to tackle cost. This set the context for much of what followed from 2004 – 2006.

The premise of the merger of thetrainline and Qjump was that £8m of savings could be made, delivering a roadmap to profitability (the businesses were already making a profit before tax, interest and depreciation, but that masked the ongoing investment need, and gave little room for the marketing required).

The operational side of the business saw the biggest change. The closure and outsourcing of the former Qjump contact-centre was followed by off-shoring of most of thetrainline contact centre operation, a big impact for Dingwall where about 10% of the working population worked there.

Various changes were made to the proposition to generate additional margin, such as the addition of credit card fees, the sale of add-ons such as insurance policies, and showing third party banner adverts and pop-ups.

Technology investment continued, but the impact upon customer experience was less transformational than the previous period. Many investments were to allow customer self-service to reduce helpdesk costs, systematically tackling the cost of sale. Other investments started the journey of establishing in-house development capability to migrate away from some of the third party systems in use. An early focus was thetrainline.com developing its own ticketing engine to print tickets or make them available to collect at stations. Justified as a cost saving initiative, crucially it would also establish the capability to be used in due course to innovate with new forms of ticketing such as "print at home" and mobile ticketing.

In the year to March 2006, thetrainline sold ~ £400m of train tickets earning revenue of £47.5m and Ebitda of £11.7m. It operated retail websites for 16 of the 21 Train Operating Companies as well as providing business travel services direct to a number of blue-chip corporations and travel agents.

There were, however, a couple of looming problems for thetrainline – technology and competition.

The technology platform that thetrainline ran upon largely originated from 1997. An Oracle database, with a Microsoft ASP/Visual basic application and frontend. It was early web technology. At a time when the internet was evolving rapidly, it was now very dated. It had been scaled by adding more and more servers to the problem. Furthermore, the frontend user experience was feeling increasingly tired. Lots of pages, “please wait” pages and no predictive text or data pickers to make data entry easy. Train company clients, particularly Virgin, were applying pressure to be brought up to date, and were frustrated by the pace and cost of change. Capgemini, (thetrainline’s partner since day 1), provided a proposal to replatform the business, but thetrainline concluded it would lead the replatforming itself, outsourcing development to Hexaware in India.

New players

Whilst Virgin was applying the pressure for thetrainline to update its systems, the other main Anglo-Scot operator, GNER, had a different plan. It had been a customer of Qjump, but the merger resulted in it becoming a customer of thetrainline. thetrainline was owned by Virgin, its main competitor on the Anglo-Scot routes. Uncomfortable with the position it found itself in, GNER decided to go to market to develop its own online retail capability, and in early 2006 it appointed Atos Origin to develop and run its own internet retail platform.

Whilst GNER’s plans were very visible, another future competitor was quietly incubating well below the radar. In 2004 a modest travel agency, Harry Weeks Travel, launched an online booking service for travel agencies, called Evolvi. HWT would go on to be acquired by Capita, and the Evolvi platform would become a sizable player in the rail business travel market.

Virgin exit

In June 2006 thetrainline was sold to Exponent Private Equity for £163m. By this point the future of online retail as a concept was no longer in doubt, but it needed to invest in the next generation of technology, invest in marketing and improve its product to protect its market leading position, and accelerate growth. In addition to replatforming the plan included new ideas such as the promise of ‘interactive Digital TV’ to grow reach, and dynamic packaging with hotels and events to grow the breadth of the offer.

thetrainline was now independent, with no ownership relationship with train operators. The flip side being that the industry relied upon an independent business for its highest growth channel. This would set the scene for the next chapter.