2006 was an intense year for many of the 90 strong thetrainline team. Selling the business and supporting the vendor due diligence process, straight into agreeing the business plan with the new owners. A new “third party investor licence” had to be negotiated with ATOC (the forerunner to what is now RDG) as previously the business had operated using Virgin Trains’ entitlement to sell tickets. The small technology team also had to spin up the programme to migrate to a new technology platform, and deliver Virgin Trains their much wanted new website. The business had been “running hot” for a long-time, accumulating technical debt and straining the goodwill of clients. Going into 2007 it was becoming difficult to keep all the plates spinning.

Wobbles in thetrainline’s customer base

An early casualty was National Rail Enquiries (NRE). In late 2002 thetrainline had beaten competition from Qjump to win a long-term contract to provide the journey planning and fares part of the National Rail Enquiries website. However, faced with growing demands from its stakeholders, NRE had become frustrated with the slow pace of delivering enhancements and new features. It decided to commission a consortium led by Thales (who already provided live train information) to build a replacement site. There was a long-term contract with thetrainline, but it was non-exclusive and volume based. NRE chose not to challenge the contract, but simply to put no volume through it.

Replatforming woes

Undoubtedly the most significant challenge was thetrainline’s replatforming programme. The leap from a fully managed service with Capgemini, to directly managing an offshore development partner in India appeared to be a stretch too far. A new technology partner was brought onboard: initially as consultancy to advise, followed later by taking over the development with their own teams – reported at the time to be ‘the world’s largest agile software development project’. Nonetheless the programme would take much longer than planned, and the pressure to deliver the visible front-end changes, whilst deferring work on reengineering the backend, created technical debt that lasted a decade. The phased migration meant many functions were duplicated in both old and new platforms, and essential changes had to be made in both.

Fraud

One challenge in 2007 had the potential to stop the online rail retail dead in its tracks: payment card fraud. Fraud had been a simmering problem right from the early days, but in 2007 it was at risk of becoming an existential problem. Online rail retail was an attractive target. Unlike physical goods that would require a delivery address, which could be traced, tickets could be collected at the station largely without trace. Tickets were relatively easy to resell, or could be used in organised crime directly. Process controls had been introduced that required customers to use the same card at the point of collection, but these weren’t systematically enforced at ticket offices, and at the time self-service machines could be tricked with skimmed or stolen cards (this predates “chip and pin”).

It's worth noting at this point, that the retailer is responsible for the cost of taking payment, and any payment fraud liability. For example, a retailer sells a £50 ticket, it earns 5% / £2.50 commission on that sale. At the time, the cost of processing ‘cardholder not present’ payments was 1 – 1.5%, so it’s immediately down to < £2 net income. If the transaction is fraudulent, the retailer is then liable for the full £50 cost of the ticket, often plus an admin fee from the payment provider, despite having only received £2.50 commission from the sale. In the high-volume low-margin context, this can be devastating. Furthermore, where retailers have high rates of fraud, the payment card industry reacts with a higher propensity to decline cards for that retailer. The retailer may think that their fraud problem is reducing, but at the price of having a high percentage of legitimate customers having their payment attempts declined.

In the early era police interest was lack-lustre. I still recall their initial response. This simply stated that we were to blame by taking card payments without a signature, and their recommendation was that we should require payment by cheque, and wait for the cheque to clear before issuing the tickets. This attitude pivoted when the police had the realisation that much of the fraud we were seeing was related with serious organised crime, and that was worthy of interest for what it might lead to.

Payment fraud remains a challenge to this day. Most retailers large and small have unfortunately had their own wakeup call at some point, often despite thinking they have all the relevant controls in place. It can be particularly brutal for new entrants, who often prioritise work on functionality. Fraud risk management is a discipline and a department in its own right in the larger retailers.

Ecebs

Somewhere amongst this, thetrainline somehow found the time to acquire Ecebs, the East Kilbride based smart card specialists that ran key components of the GB smart card ecosystem used for concessionary travel cards and regional ticketing. At the time the thinking was that Smartcard would be the next big leap in ticket fulfilment. Customers would have a thetrainline membership card, to which their tickets would be automatically delivered as they tapped in at the station ticket gates (akin to Oyster). The cultures of the organisations couldn’t be further apart: thetrainline from the often chaotic consumer centric dot.com school, Ecebs from the calm and careful world of cryptography and secure systems. (Incidentally, Ecebs must be one of the most acquired businesses in the sector, later being acquired by Bell ID, then Rambus, then Visa, and most recently Unicard)

Booking fees

It is impossible to cover online rail retailing without commenting on booking fees.

Booking fees were introduced by thetrainline in late 2007, originally 50p for tickets collected at the station, and £1 for tickets sent out by post. This approximately matched what thetrainline was charged by the industry for station collections, and the cost of post respectively. Prior to this point, customers paying by debit card incurred no additional fees (albeit fees were charged on credit cards). Most, but not all, other independent retailers have since also adopted some form of fee model.

It was a very difficult decision, with some profound consequences.

When online launched, rail commission was 9% for all tickets (except season tickets, which attracted 2%). Over time, different commission rates were introduced for different retail channels, and online commission dropped initially to 5.5%, currently 5%, and is dropping to 4.5% next year.

As outlined earlier, the retailer also carries almost all of the marginal cost of sale, such as systems costs, payment processing, fulfilment costs and any losses such as fraud and lost in post.

The early days of online had largely been about long-distance travel with relatively high average journey values (around £50 for Qjump), but as volume grew the average journey value was getting lower, and would gradually head towards the overall industry average journey value of around £10.

The economics were too tight – it was impossible to have no booking fees, whilst continuing to invest in marketing and enhancing the proposition. To put this in context, at several points in my time on this journey, we had management team decisions around which suppliers we could afford to pay on time, to leave enough money in the bank to be able to pay payroll.

The introduction of booking fees had at least two consequences:

- It meant retailers had to invest in their platforms to make them worthwhile, and justify the extra fee

- It gifted train companies (who were not allowed to charge booking fees) the differentiator of “no booking fees” – which featured in most marketing for more than a decade

Whilst some customers seek the lowest cost way to buy their tickets, overall customers have been tolerant of fees. It irks many in the industry who expect passengers to exhibit homo transporticus behaviour (see Rory Sutherland/Pete Dyson's Designing Transport for Humans for explanation). However, in practice people prefer familiarity, prefer the usability or features of a particular app, or just exhibit a brand affinity. The argument of duping customers with "hidden fees" doesn't seem to stand up either, as evidenced by the proportion of repeat custom for those businesses charging fees. A lot of marketing money has been spent on "no fees when booked direct" messaging, that targets a relatively small portion of the customer base that see the fees as a problem.

Industry sentiment

Outside of thetrainline, the industry sentiment to online ticket retailing was changing. For the first half of the decade many TOCs had tended to regard online retail as a cost overhead in the same bucket as contact centres. Whilst there were inevitably some enthusiastic commercial directors and marketeers who wanted to get their hands on it, the overarching sentiment in most TOCs seemed that it was an overhead, or even a threat to ticket office volumes. There was cynicism about whether thetrainline would survive, and an air of self-congratulation from those owning groups that had exited their interests.

The sentiments, however, were starting to change. Internet use was now mainstream, and "Web2.0" was making it accessible to those that were less tech savvy. Blackberries had replaced pagers on the belts of most railway managers, Virgin had just sold thetrainline for £163m, and GNER were busy building their own online retail platform with ATOS origin. Harry Weeks Travel had made significant inroads into the business travel market, as ATOC withdrew the Elgar system it previously provided.

Gradually online retailing was interesting again and people wanted to be part of it.

How that manifested itself varied. thetrainline had been sold with long-term contracts in place with Virgin and the National Express TOCs. Now thetrainline had been sold these felt like an uncomfortable legacy with limited commercial teeth. The other 12 TOCs, however, were not as constrained. In December 2007 GNER launched their new platform, which had been 18 months in development with Atos Origin. A few weeks later, the GNER franchise ended, and there was much speculation as to whether the incoming National Express franchisee would revert to thetrainline. They didn’t, and National Express continued on the Atos platform. By 2010 Southern, Southeastern, Chiltern and London Midland had joined them, followed later in 2012 by the First Group TOCs.

RailEasy

Figure 9: Raileasy website

2007 also saw the first of a new generation of independent retailers set-up in competition to the TOCs and thetrainline, with the launch of RailEasy.

RailEasy is still run by its founders today - probably the longest serving management team in the market. It originally used the same ICL/Fujitsu journey planning/fares engine that had been used by Qjump. It later spotted the opportunity of split ticketing, and helped establish trainsplit.com, investing in a journey planner that would have the capability to find cheaper ticket combinations than the through fares. A significant proportion of their growth has come from offering their API to new entrants to the rail retailing market, without needing to build their own rail technology capabilities.

National Rail Enquiries

Periodically the light would shine upon National Rail Enquiries, and the potential to add retailing to its capability and provide a single online channel for the industry.

It is worth taking a brief diversion to share my views as to why it has never happened.

It would seemingly make sense to customers, not needing to navigate the different train company brands, and (on paper at least) one system should be more cost effective than many (albeit what you gain with deduplication, you also lose with competition).

I suspect there was some naivety about the scale of what it would involve, but those assumptions never got to be tested. I heard it described as “why don’t we simply put a payment page on NRE and be done with it?” It would, of course, have needed far more than that. It would have needed a full retail organisation, ticket fulfilment, customer support, aftersales functions such as refunds and changes; financial accounting and reconciliation, along with fraud management; data and insights; marketing and conversion rate optimisation; product management; customer research; alongside investigating and escalating for resolution the inevitable data errors that would cause incorrect tickets to be sold. All no doubt possible, but a big leap from “just stick a payment page on it”.

Plans got to various stages of maturity at different times, but were never approved. To understand why, you need to start with NRE governance and decision-making process.

Like much of the central fabric of the industry, NRE is owned collectively by the train operating companies, who also nominate representatives to its board. A decision to retail tickets, therefore, would need to be collectively made by the train companies. Prior to 2006, the shareholders of 13 of the 25 train operators also owned part of thetrainline, and were unlikely to vote to undermine their investment. In the second half of the decade online retail was increasingly seen as a potential commercial differentiator. A better retail platform would attract more customers, allow better conversion and retention, support better marketing, at a lower cost of sale and ultimately therefore allow an owning group to bid a higher premium to win a franchise. Many owning groups felt they needed the capability for online retail in their own kit bag, not simply subscribing to a centralised service. Long distance TOCs felt that their own sites, focused on their own products, would convert better than a “jack of all trains” site trying to cover every possible market. There was also the perennial issue of when the costs and benefits would fall. At any point in time, different TOCs were at different stages of their franchise cycle. Some would have recently invested in their own online capabilities, others would be just about to hand back franchises and be resistant to approve any “cost now, benefits later” industry projects. Others shared a cynicism that the centre was expensive and inefficient, and would rather retain direct control. Different stakeholders will put the emphasis on different reasons, but whatever the weighting, it was never possible to get the consensus that this was the right thing to do.

Fares Simplification

Online retail exposed fares complexity, and catalysed the creation of additional complexity as train companies created more fares to react to the emerging market.

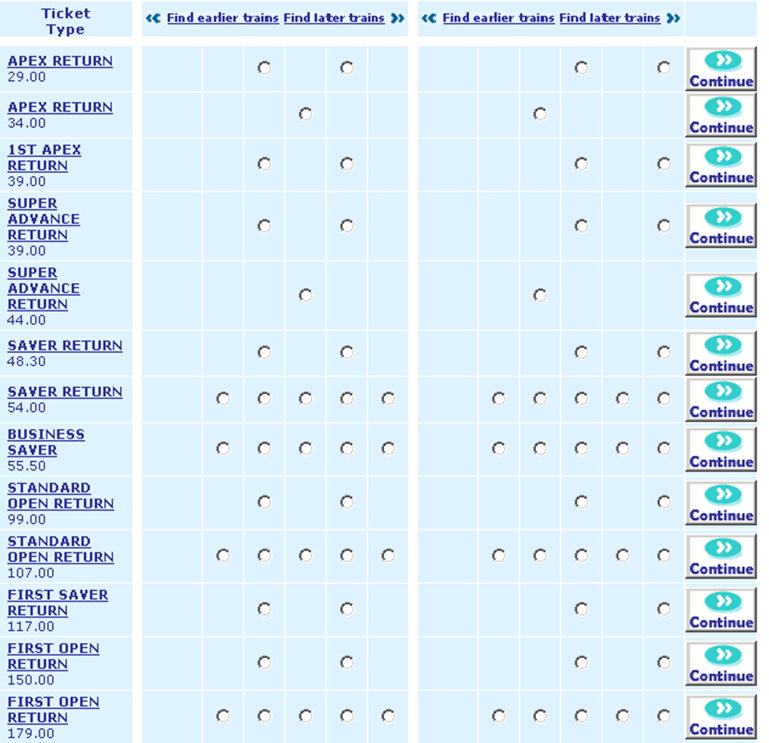

For the first time, customers were able to see the full range of choices available to them. This was a mixture of recognised products inherited from British Rail such as the Cheap Day Return, Saver, or Apex, combined with a plethora of new products such as “Virgin Value”. Some tickets were sold as singles, others as returns. Websites typically listed every product, and it often wasn’t obvious to customers what the differences were. Quite often you would be offered fares for which there was no rational reason to choose.

Fares simplification was welcomed by some as step in the right direction, whereas others felt it was a missed opportunity. It predominantly dealt with creating four main ticket categories: Anytime, Off-Peak, Super Off-Peak and Advance, and mapping previous ticket types to the new categories. A ticket office clerk dismissively summarised the change to me as “We used to have the Cheap Day Return, Evening Return, and Weekend Return. We now have the Off-Peak Day Return, the Super Off Peak Day Return and the Super Off Peak Return, and apparently that makes it more obvious which one you need.”

Despite the limitations, significantly for online retail it harmonised the terms and conditions of train specific “Advance” fares, and made the move to selling all “Advance” fares as single tickets. This was a significant help for online retail, as it meant that only the cheapest Advance fare for a given train needed to be displayed to customers. The retention of return tickets for other ticket categories meant that customers still had to decide between return tickets or combinations of single tickets, which significantly complicates the way in which choices can be presented online. 15 years later the industry widely recognises that comprehensive single leg pricing would be preferable, but progress towards that state remains relatively slow.